Understanding DCF Valuation for SMEs and Startups

DCF valuation for SMEs and startups is one of the most widely used financial methods to estimate a company’s true economic value. Whether you are raising investment, preparing a feasibility study, or evaluating business expansion, understanding how DCF works can help entrepreneurs in Qatar make smarter, data-driven decisions.

At Rowwad Advisory & Business Solutions, we regularly use DCF analysis in feasibility studies, financial models, and investment cases to help business owners and investors understand the long-term value of their companies. This guide breaks down the DCF method in simple, practical terms without unnecessary complexity.

1. What Is DCF Valuation?

Discounted Cash Flow (DCF) valuation is a method used to estimate the value of a business based on its future expected cash flows.

Instead of focusing only on today’s profit, DCF looks at:

-

How much cash the business will generate in the future

-

How risky or stable those cash flows are

-

What those future amounts are worth today

Because a Riyal today is worth more than a Riyal tomorrow, DCF “discounts” future cash flows back to their present value.

2. Why DCF Is Important for SMEs and Startups

SMEs and startups often face unpredictable growth. Investors want to understand:

-

How sustainable your business model is

-

How fast you can grow

-

When you will become profitable

-

How much cash you can generate in the long term

DCF valuation helps answer these questions and provides a realistic, financial justification for your company’s value.

For SMEs, DCF helps with:

-

Expansion plans

-

Bank financing

-

New partnerships

-

Business restructuring

For startups, DCF helps with:

-

Pre-seed and seed fundraising

-

Valuation negotiation

-

Growth planning

-

Investor readiness

3. The Core Formula of DCF (Explained Simply)

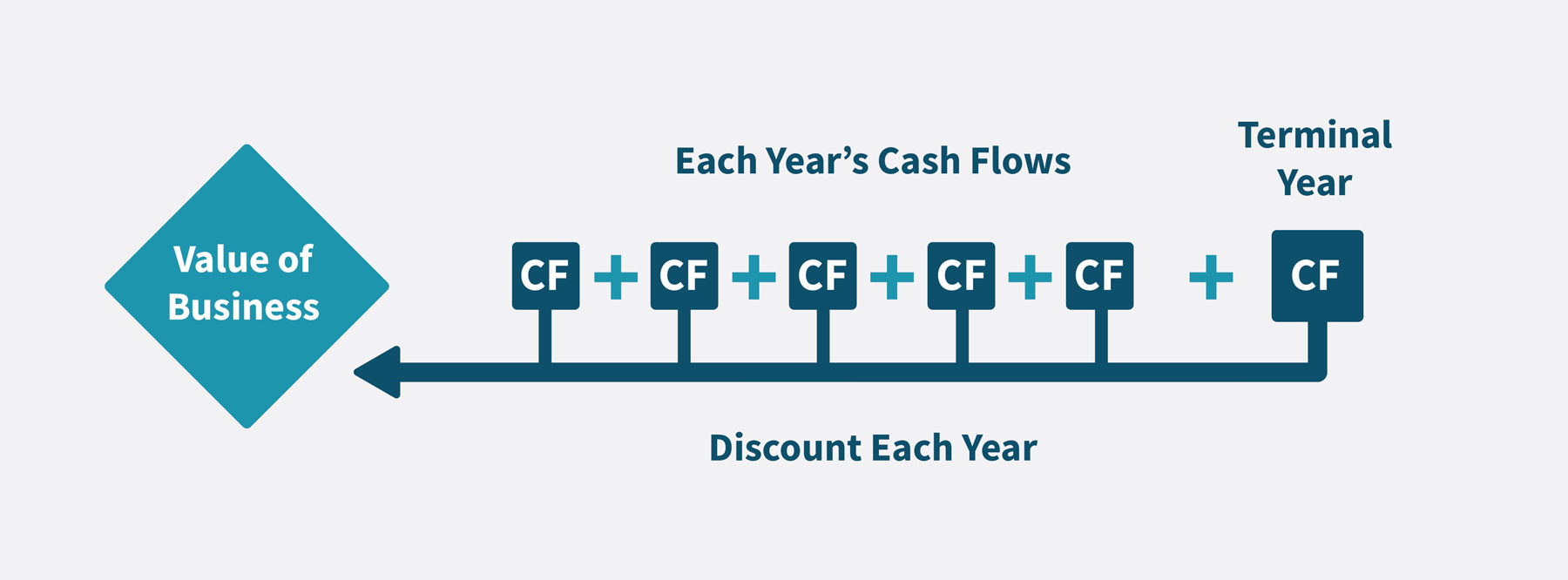

At its core, DCF follows this structure:

Business Value = Present Value of Future Cash Flows + Terminal Value

Where:

-

Future Cash Flows = profits the business will generate over the next 3–7 years

-

Discount Rate = the percentage used to adjust for risk

-

Terminal Value = estimated value of the company after the forecast period

The discount rate is usually the Weighted Average Cost of Capital (WACC) for mature SMEs, or a higher rate for startups since they carry more risk.

4. Step-by-Step Breakdown of DCF Valuation

Step 1: Forecast Future Cash Flows

You estimate revenue, expenses, investments, and net cash produced.

For startups: usually 5–7 years

For SMEs: usually 3–5 years

Cash flow forecasting should include:

-

Revenue growth

-

Cost of operations

-

Taxes

-

Working capital changes

-

Capital expenditures

Step 2: Select a Discount Rate (Risk Factor)

A higher discount rate means the business is riskier.

A lower rate means the business is stable.

Examples:

-

A stable SME in Qatar: 10–14%

-

A fast-growing startup: 18–30%

The discount rate answers:

“How risky is it to invest in this business?”

Step 3: Calculate the Terminal Value

This represents the company’s value after the forecast period.

Common methods:

-

Perpetual Growth Model (assumes long-term stable growth)

-

Exit Multiple Model (values the business based on industry standards)

Terminal value can often represent 50–70% of the total valuation, especially for startups.

Step 4: Discount Everything to Today’s Value

All future cash flows + terminal value are discounted back to present value using the discount rate.

This gives you the DCF valuation — the estimated worth of the company today.

5. Example: Simple DCF Valuation for a Startup

Imagine a startup with the following projected cash flows:

-

Year 1: –200,000 QR (loss)

-

Year 2: 100,000 QR

-

Year 3: 300,000 QR

-

Year 4: 500,000 QR

-

Year 5: 800,000 QR

Discount rate: 20%

After discounting the cash flows and adding a terminal value, the final valuation might fall between 3 million to 4.5 million QR, depending on growth assumptions.

This is how many investors determine whether your startup is priced fairly.

6. Advantages of DCF Valuation

-

Reflects long-term potential

-

Works for both early-stage and mature businesses

-

Shows the relationship between growth, risk, and value

-

Helps investors and founders understand realistic expectations

-

Excellent tool for feasibility studies, fundraising, and strategy

7. Limitations You Should Be Aware Of

-

Highly sensitive to assumptions (growth, risks, profitability)

-

Requires accurate financial forecasts

-

Discount rates can dramatically change results

-

Not ideal if cash flows are extremely unpredictable

Because of these factors, DCF should be combined with other valuation methods such as market multiples and comparable transactions.

8. How Rowwad Supports SMEs and Startups With Valuation

At Rowwad Advisory & Business Solutions, we provide valuation services that help entrepreneurs and investors make confident decisions. Our approach includes:

-

Full financial model development

-

DCF valuation

-

Market multiples & comparables

-

Sensitivity analysis

-

Investor readiness reports

-

Feasibility studies aligned with QDB standards

We support businesses in Qatar across all sectors — from manufacturing and technology to retail, logistics, and services.

Conclusion

DCF valuation gives SMEs and startups a powerful way to understand the true value of their business based on future potential, not just today’s performance. When done correctly, it becomes a strategic tool for investment, expansion, and long-term planning.

As Qatar’s entrepreneurial ecosystem continues to grow, having a solid valuation framework is essential for founders who want to raise funds, negotiate effectively, and build sustainable companies.

Rowwad Advisory & Business Solutions is here to support your journey with accurate, data-driven financial valuation services.